Timeline

Deliverables

Role

Team

MANTL worked with American Business Bank (ABB) to gather requirements for business account opening. As a team, we would take in those requirements and prioritize the features/functional requests based on effort and demand. Once the prioritization was complete, we would put the requests into a backlog and then story point each ticket for the upcoming sprint. After the designed solution passed the executive sign-off, I would set up a moderated usability test with our CS (customer success) team to ensure that solution we put together worked and solved the problem. When the solution was in a stable, testable state, we would share our QA environment with ABB to receive feedback on the solution. We prioritized our work for consumer bank account opening to follow what part of the application we were working on for business bank account opening.

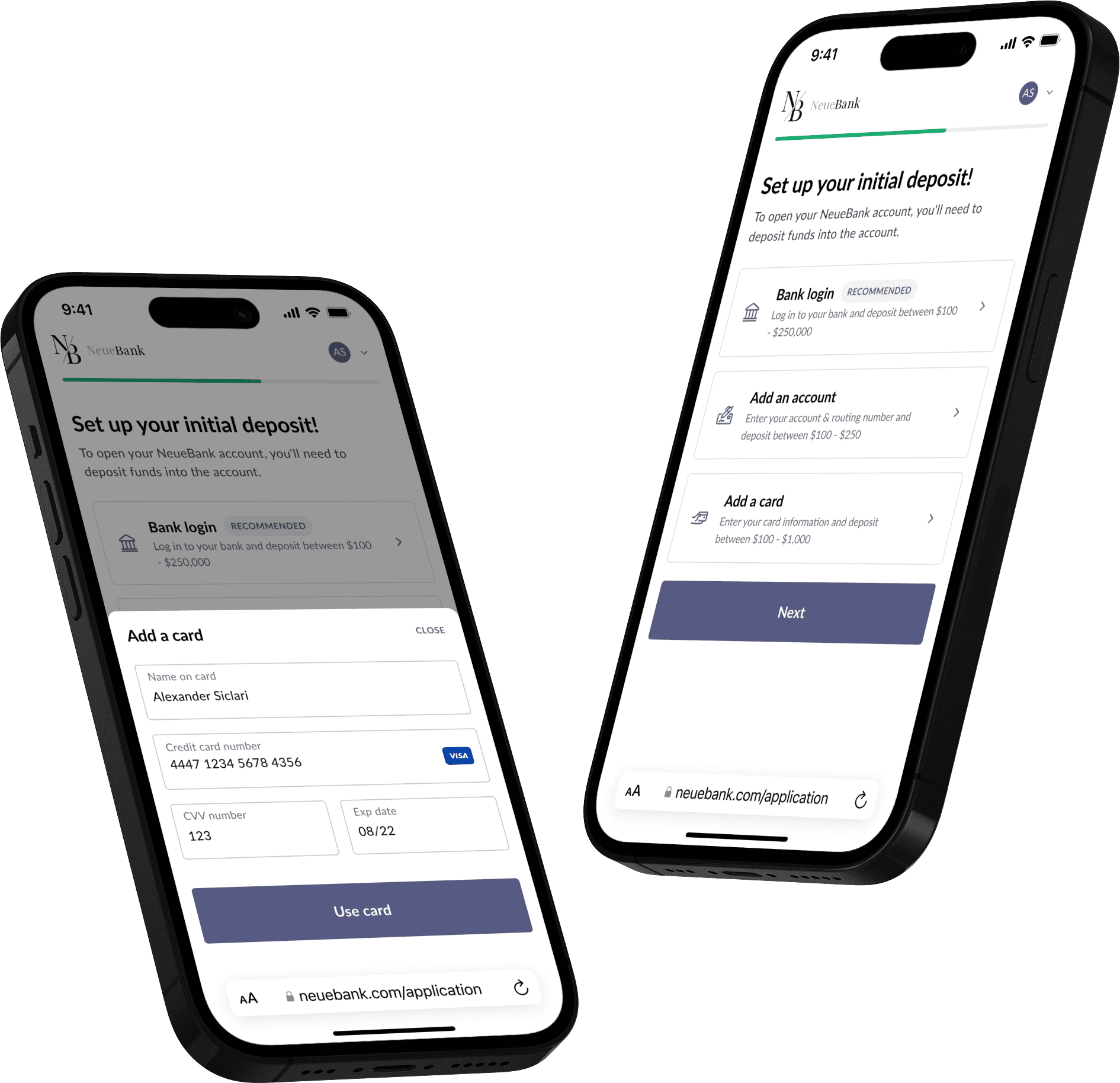

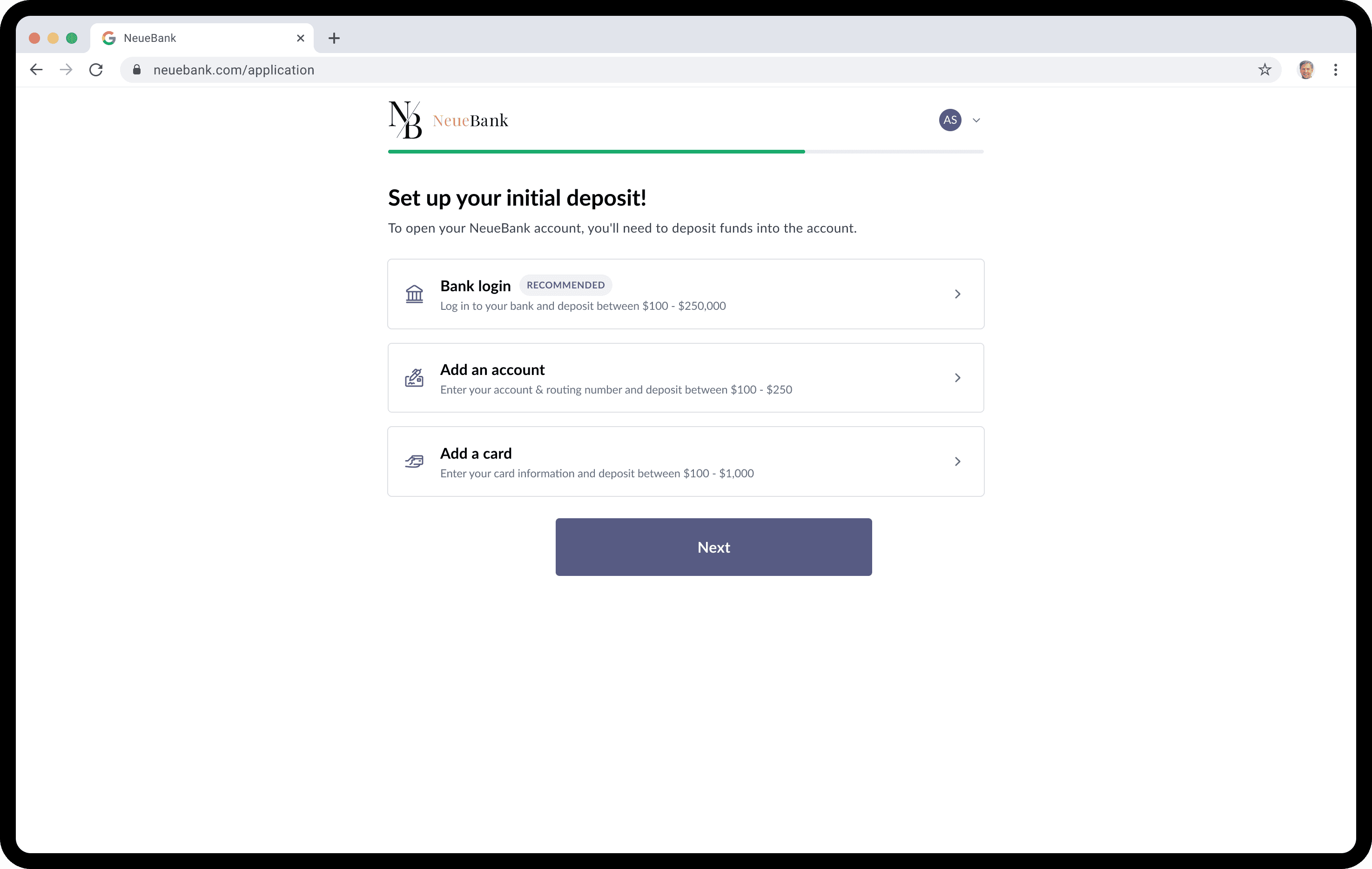

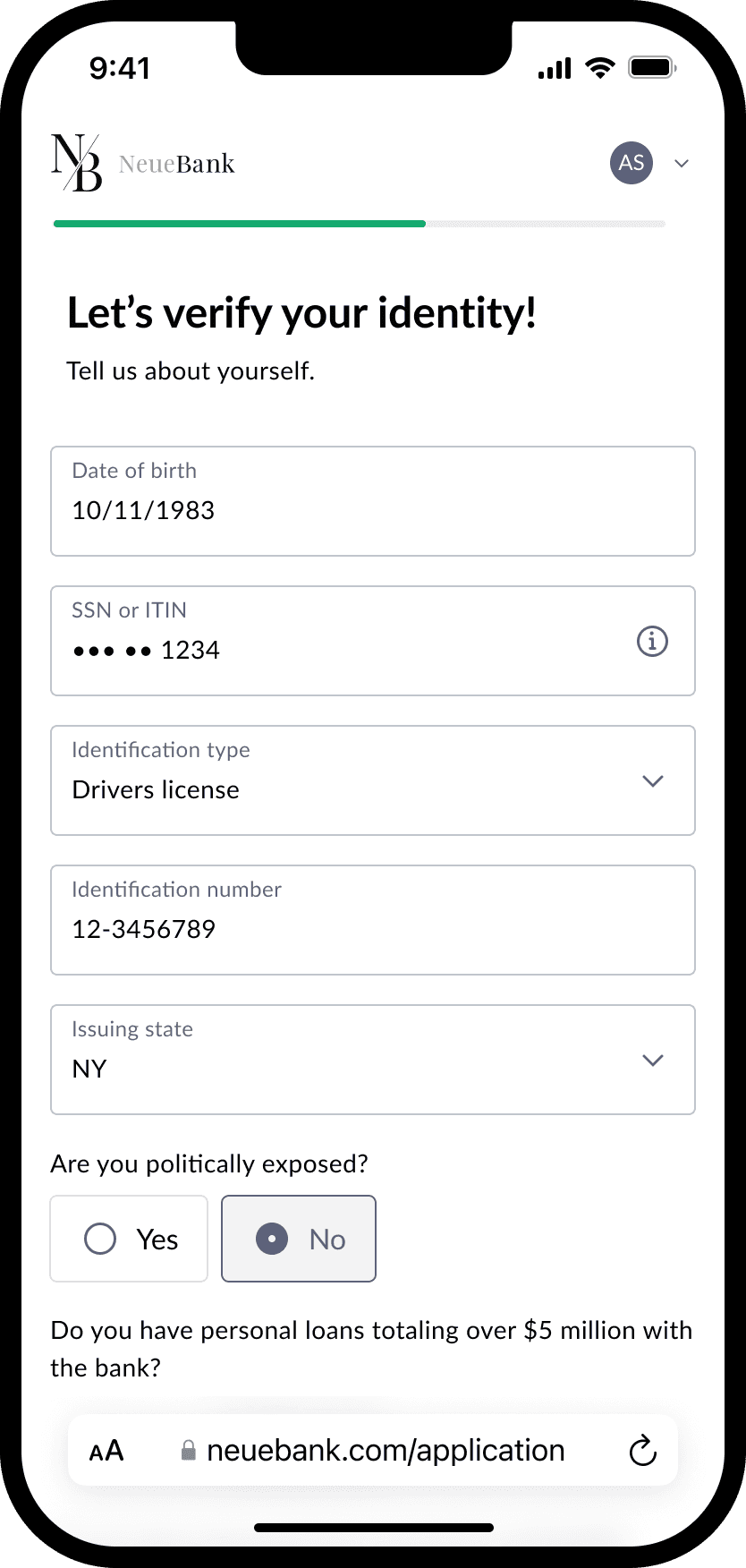

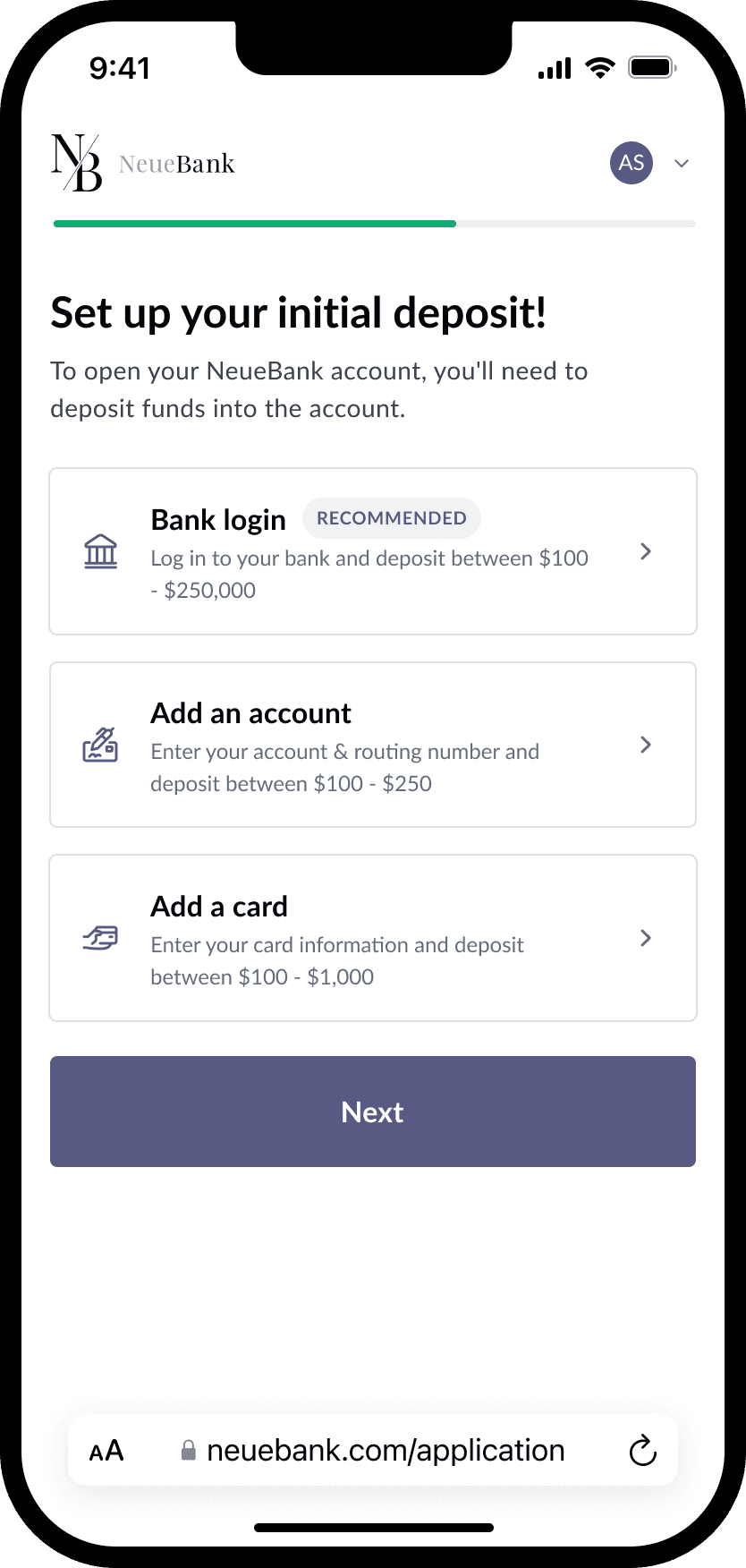

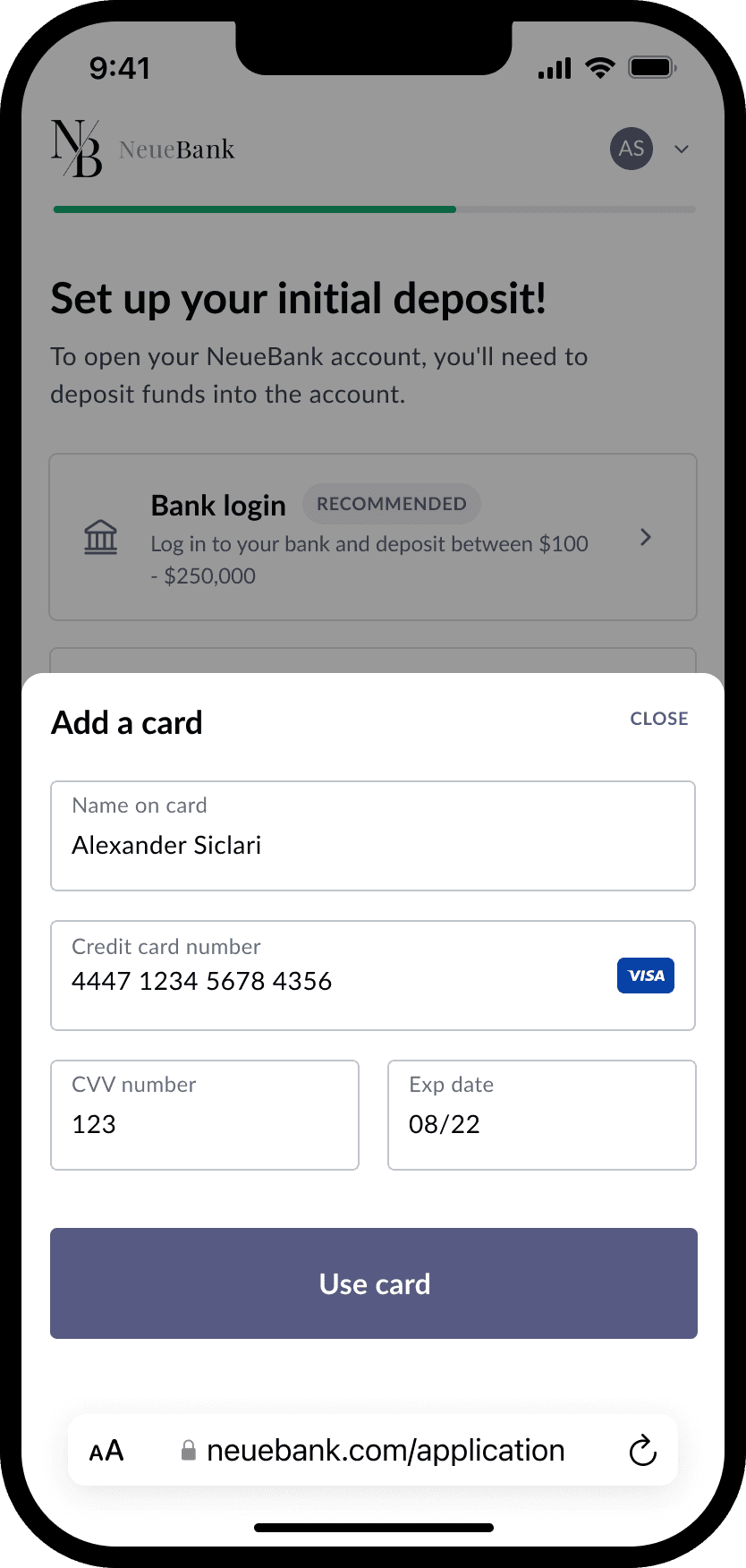

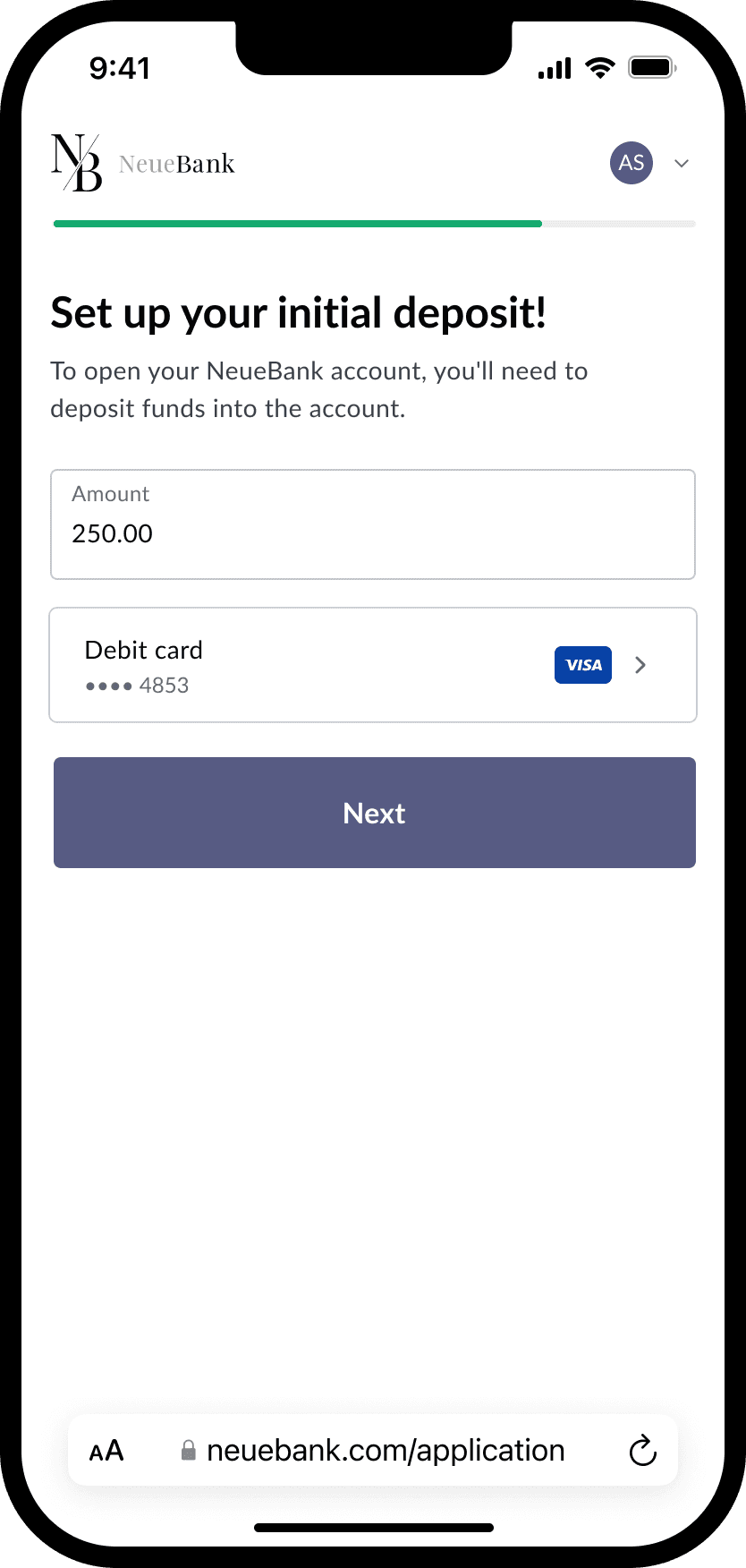

With having a baseline for conversion numbers on the consumer application, we looked at the most significant drop-off points in the application to test and improve the experience. Once we finalized the parts of the application that we wanted to improve, which were application hierarchy, simplified progress indicator, and increased initial deposit amount on mobile, we prioritized this along with the parts of the application that we were working on during that sprint.

To better understand the landscape of account opening, I gathered screen captures of our competition and other application flows in the FinTech space. Then, I laid out all of the screens captured in Figma and shared my thoughts on the positives and negatives from each application flow. Doing this helped lay out my thought process on what makes for a great experience when filling out an application.

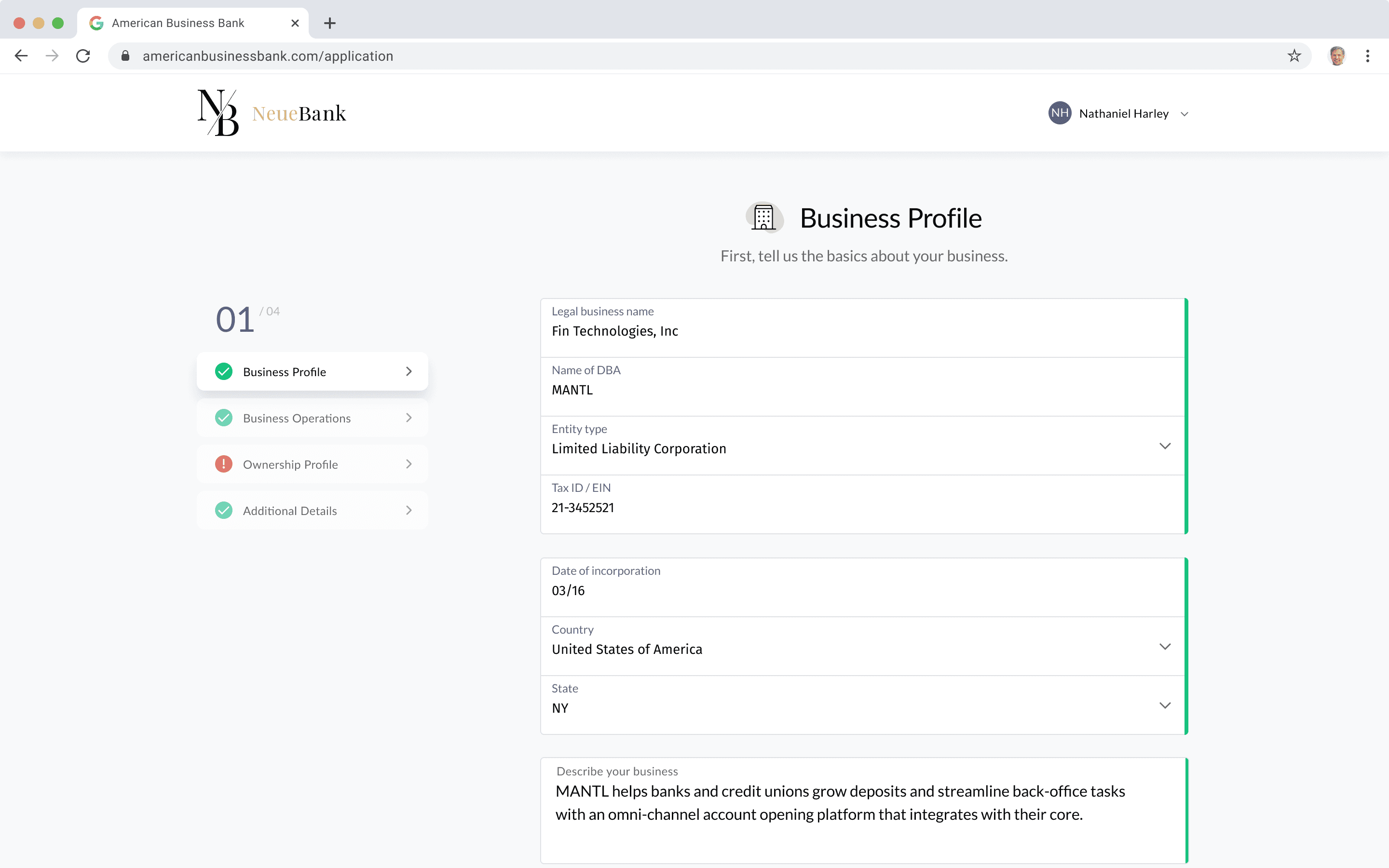

With the original goals and assumptions that we came into the project with, we focused on a single-page solution that would scroll to the next section when a user completed one section. We looked to help solve some of the routing issues in the v2 solution by having a single-page application. We had a way for the users to scroll up and down to sections by selecting one of the cards on the left column that would indicate when a section was complete.

As we started to share the work and receive feedback, a few areas came back that we wanted to improve.

• Length of Applications: The vast difference between the size of a consumer application, which was the only application that MANTL took up to this point, was much shorter and easy to navigate and complete. The increased difficulty regarding the type of information needed to complete and the number of people that could be on one application was too much for a single-page application.

• Improved Hierarchy: We still needed an improved hierarchy with the title and subtitle of sections. We also needed to improve the readability of the sections by using left-aligned text instead of center-aligned text.

• Grouped Inputs: We went for this approach in the first place to try and scale down some sections with all of the margin between input fields for the business application. We also wanted to think of a way to keep the grouped inputs for data collection associated with each other for validation purposes. Having grouped inputs could trigger multiple error states inside that set of grouped inputs, leading to either stacked errors under the grouped inputs or individual errors popping up under the grouped inputs until all errors were accounted for.

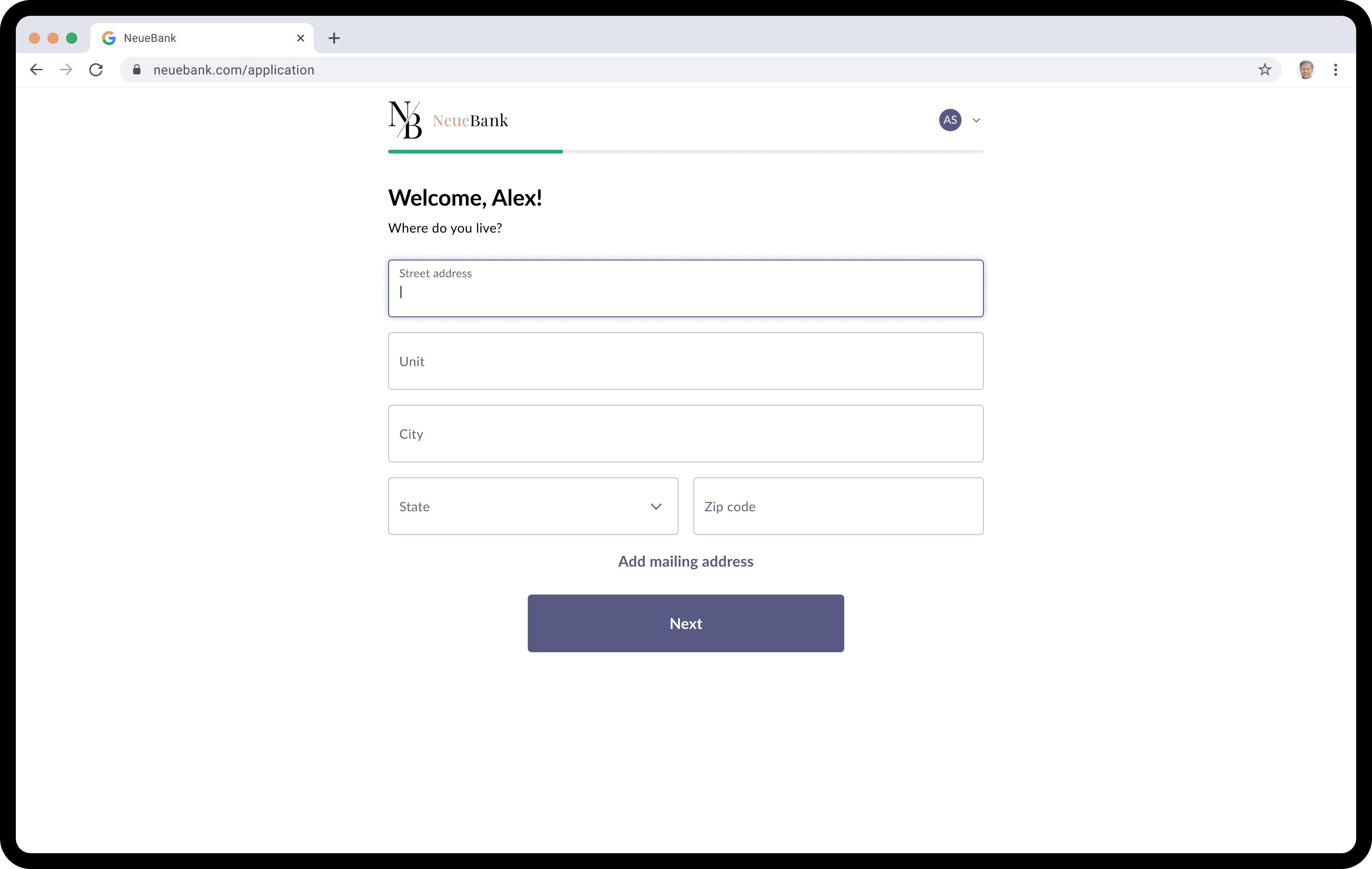

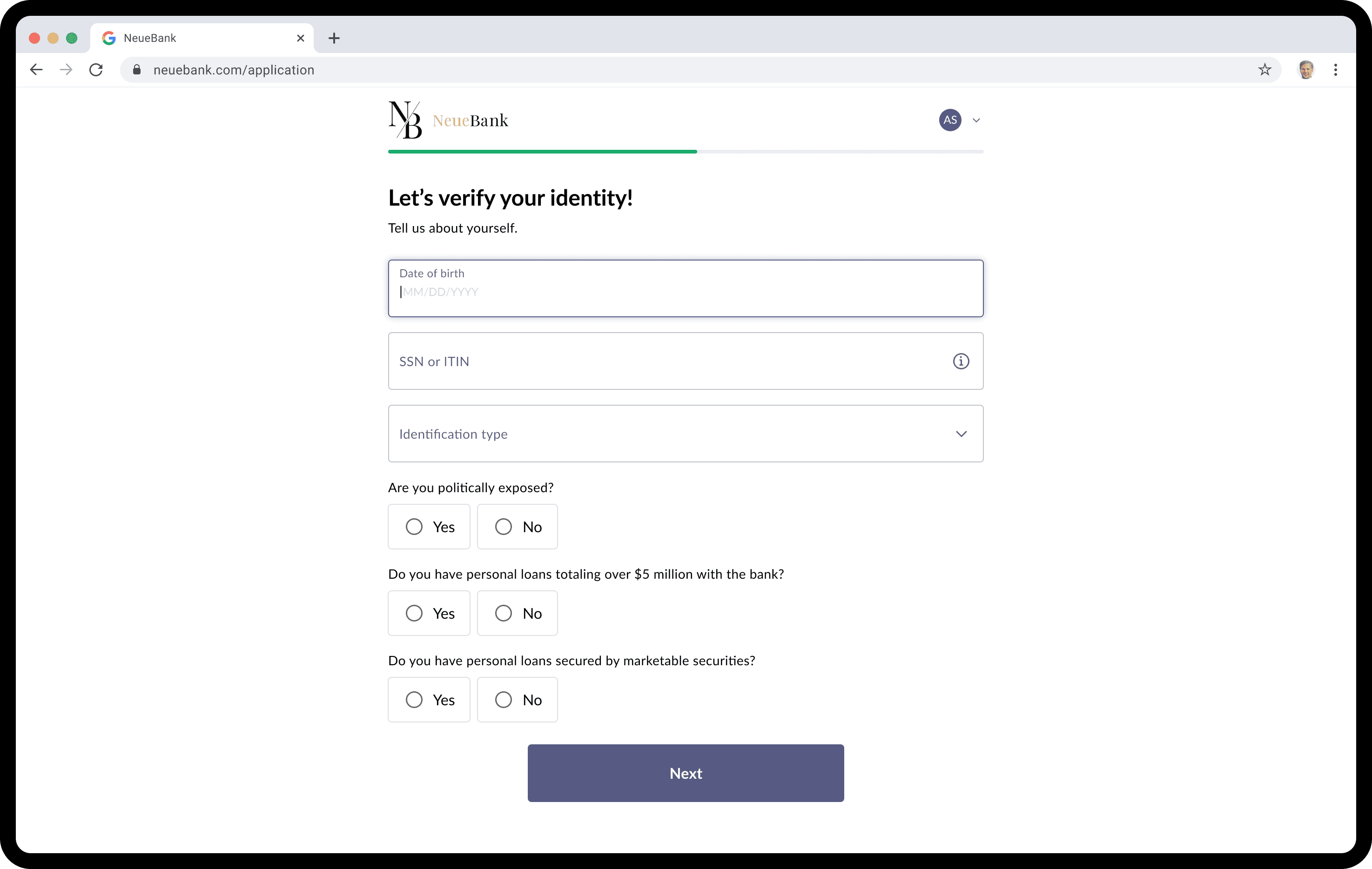

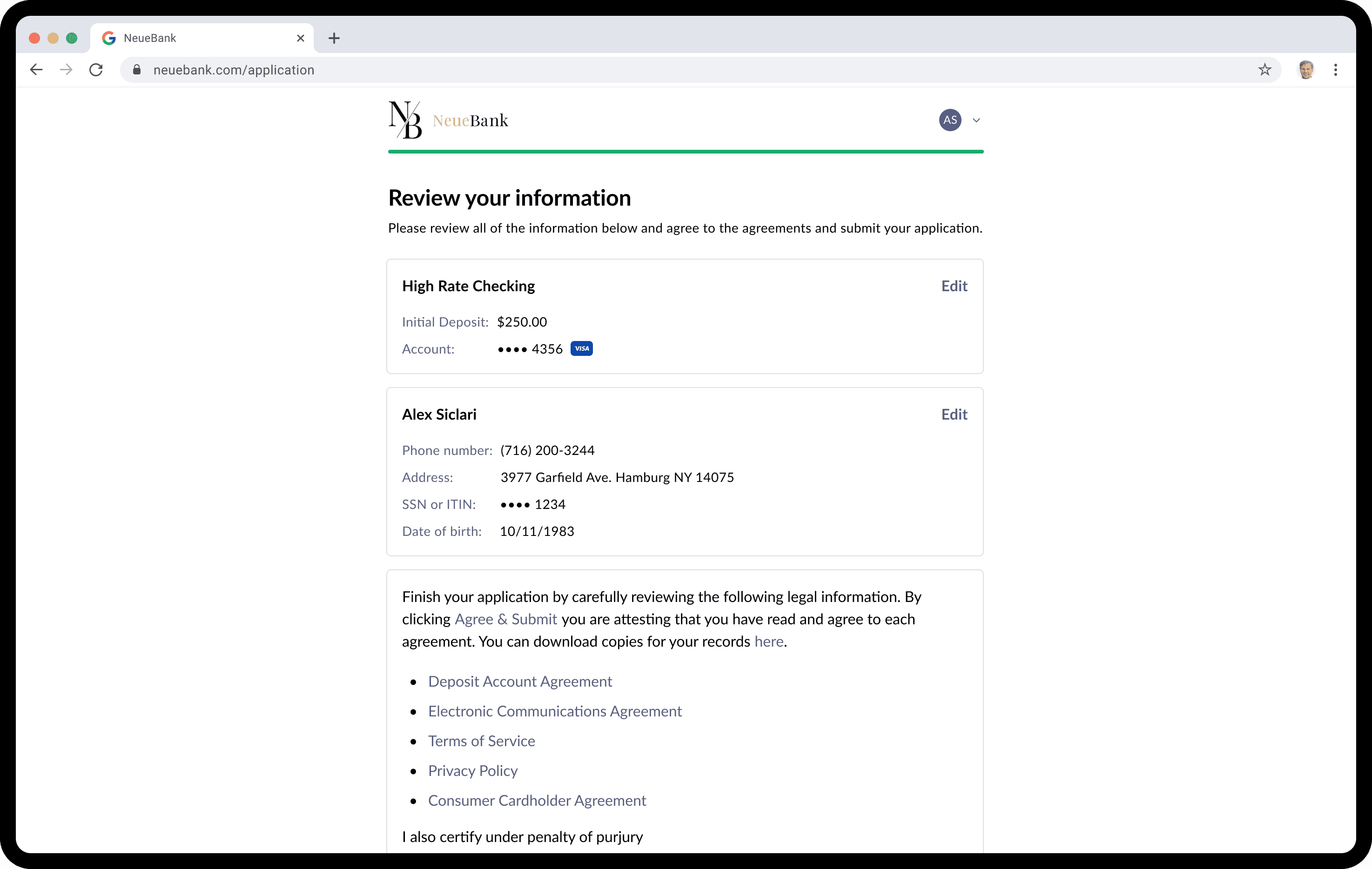

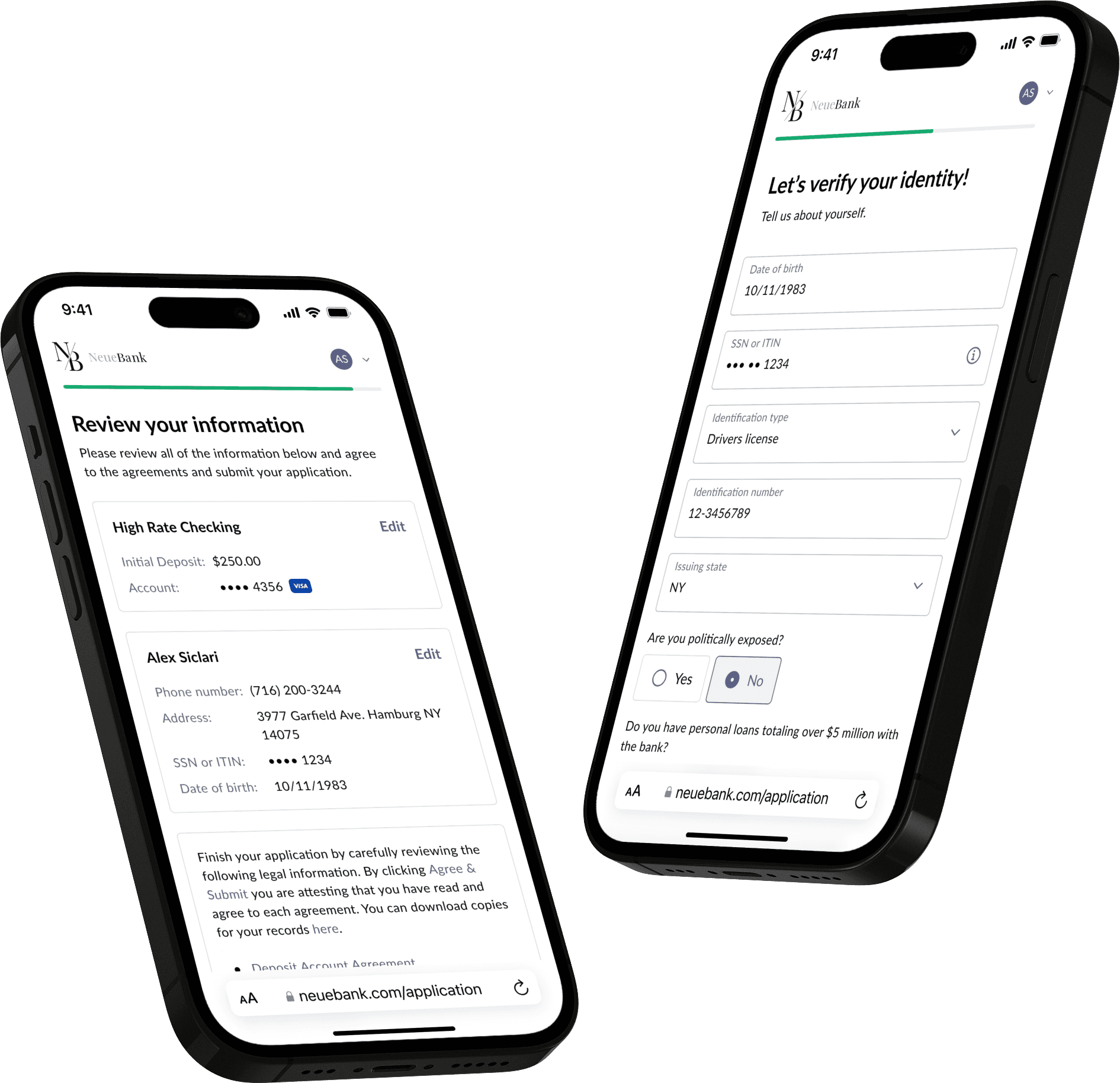

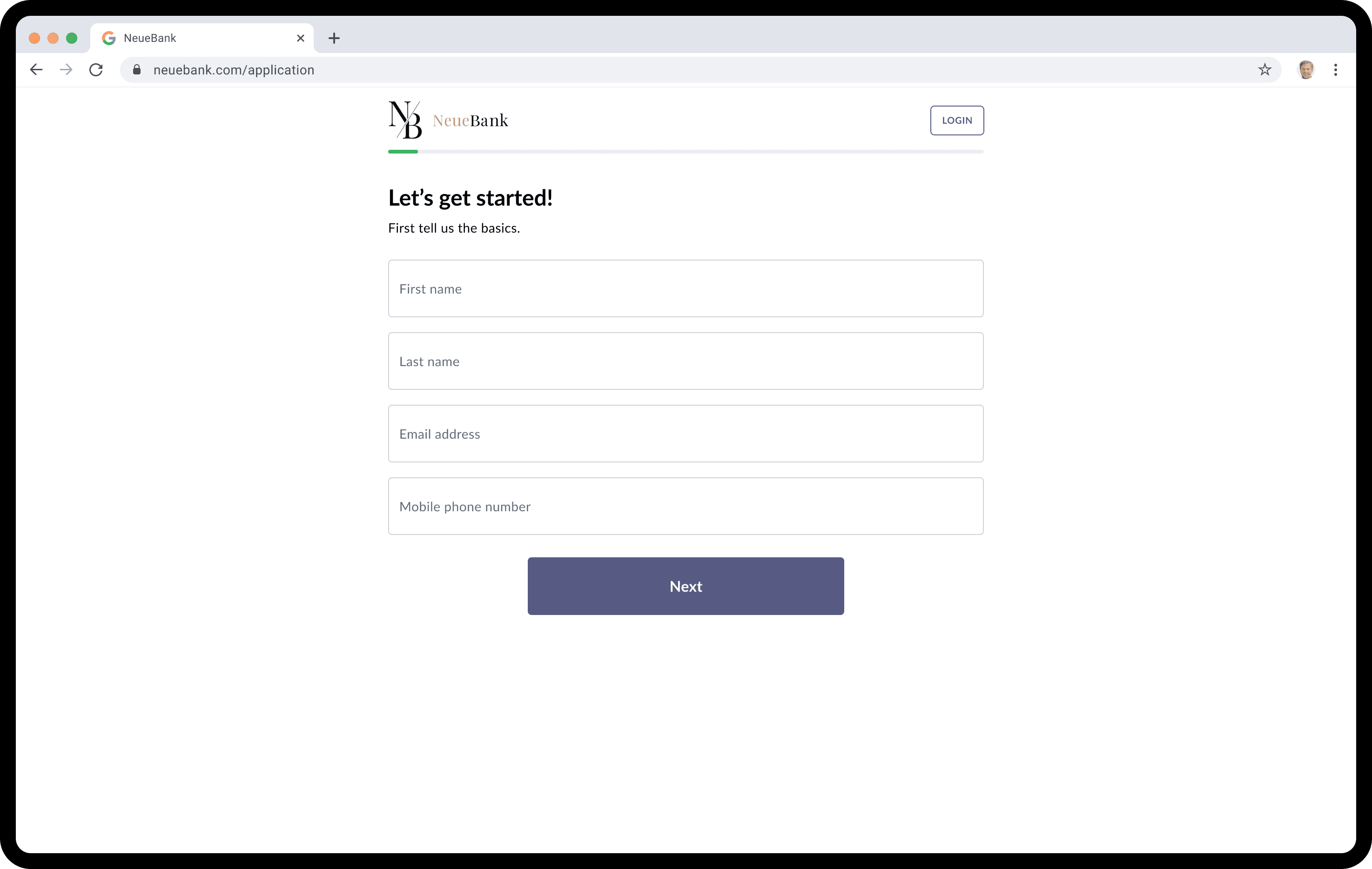

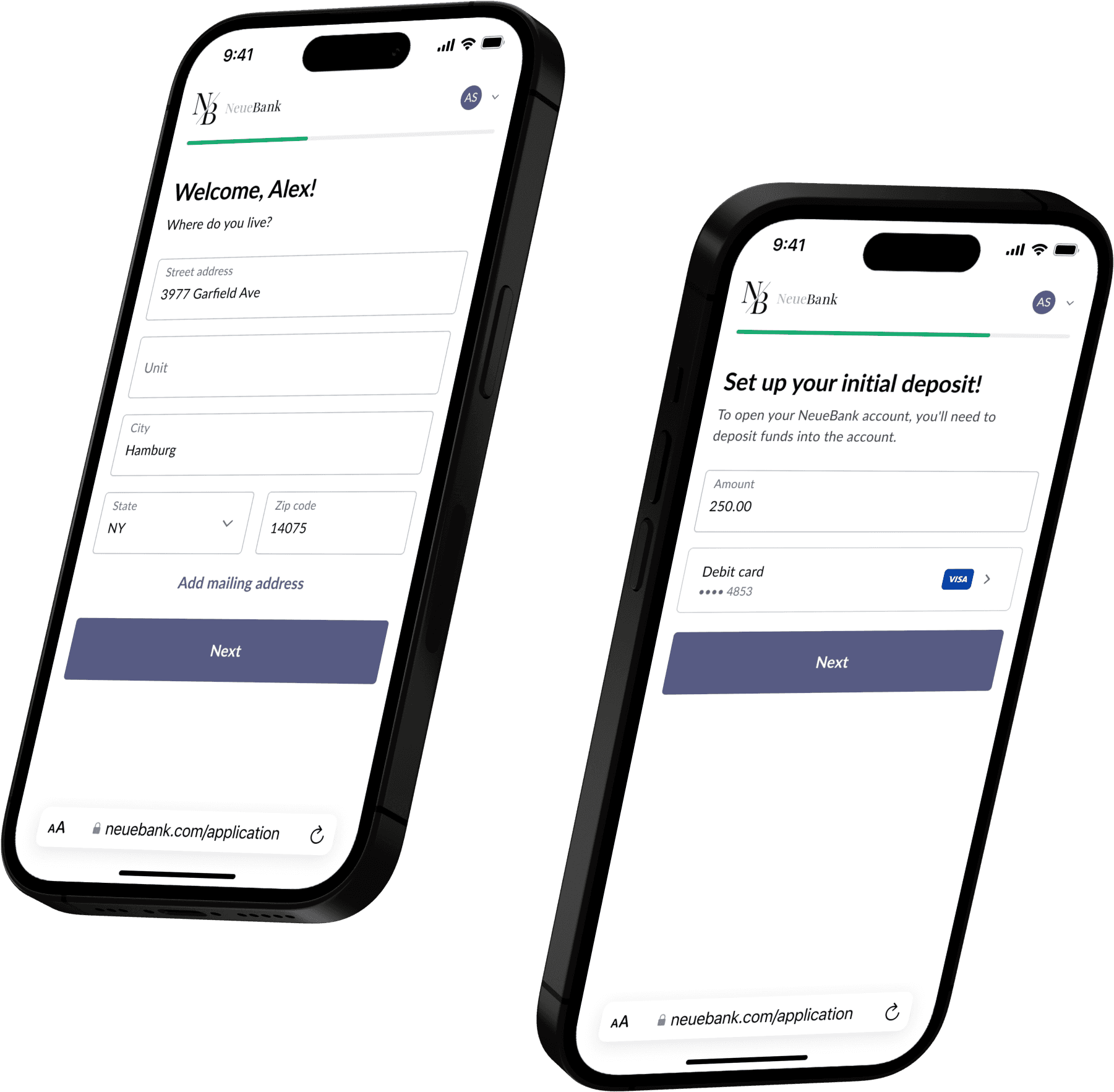

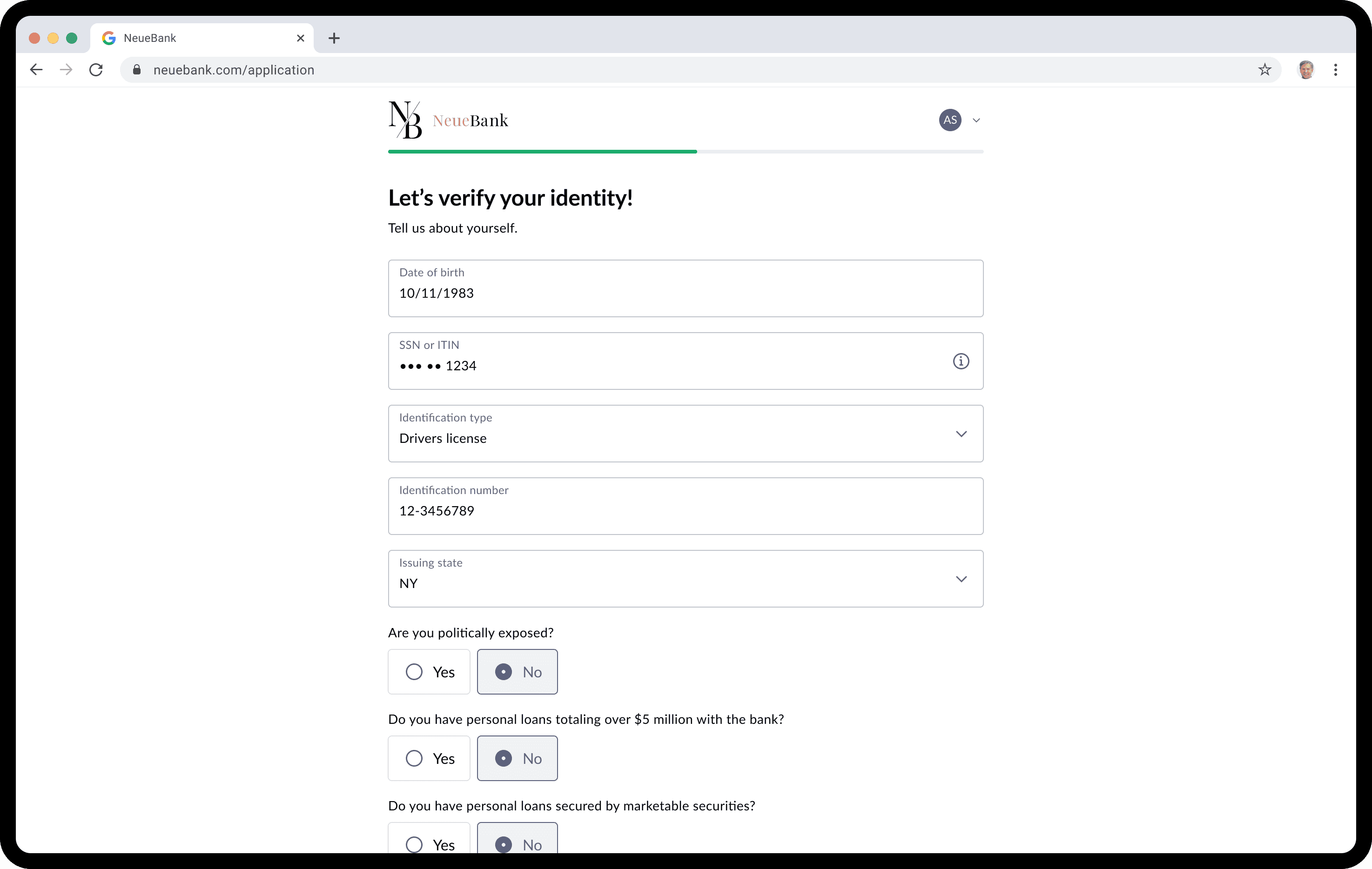

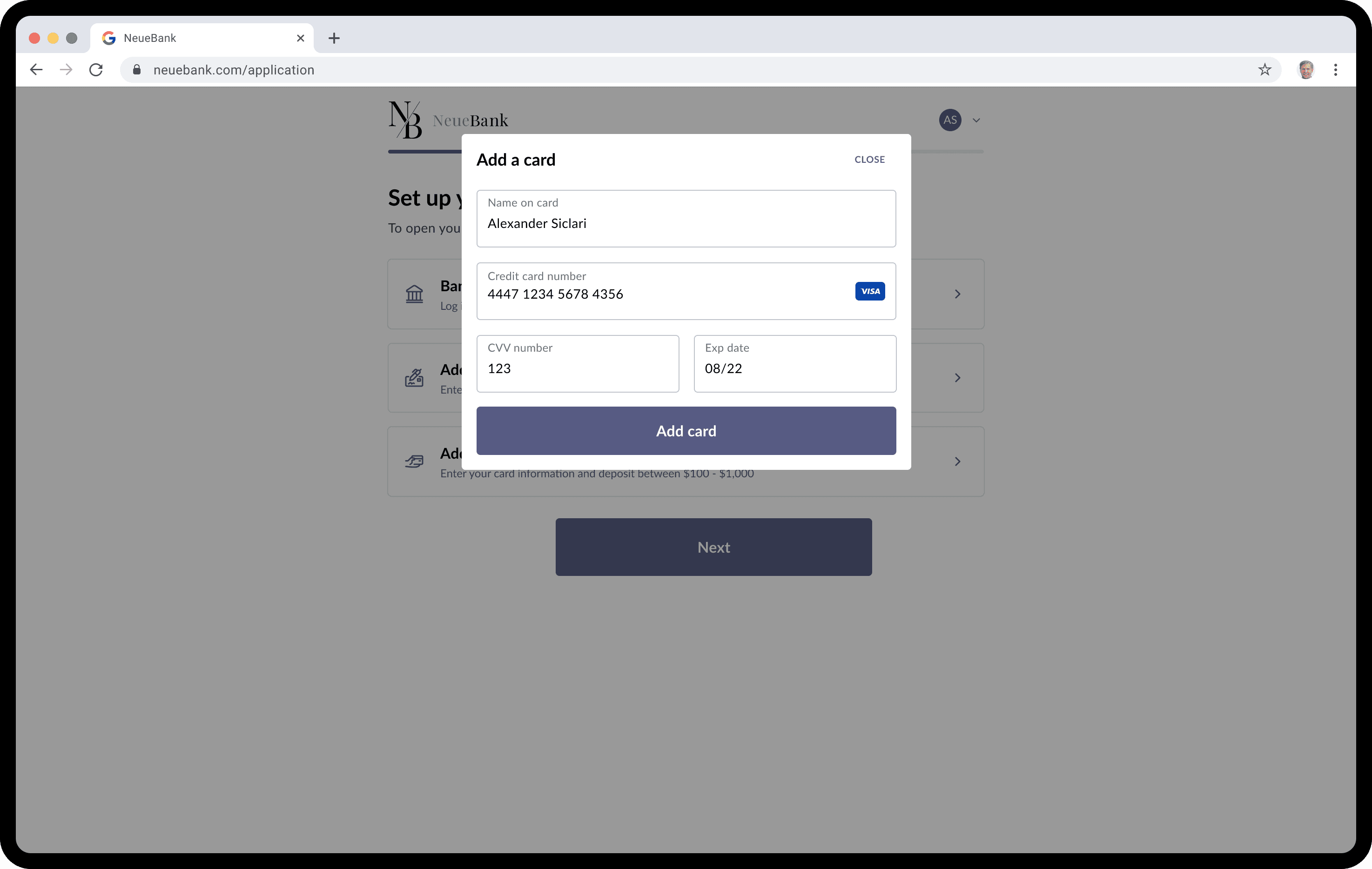

After multiple rounds of iteration and usability testing, we shifted back to a stepped approach for the application, and it made a huge difference. Users responded positively to the simplified layout, saying it was easier to digest information one step at a time without being overwhelmed by the full form. We cleaned up routing issues by streamlining user flows and leveraging native browser behavior for navigation, which felt more intuitive than the previous card-based system. We also tightened up the hierarchy by increasing title weight and aligning text for better readability, and refined the progress indicator so it complemented the institution’s branding without competing for attention.

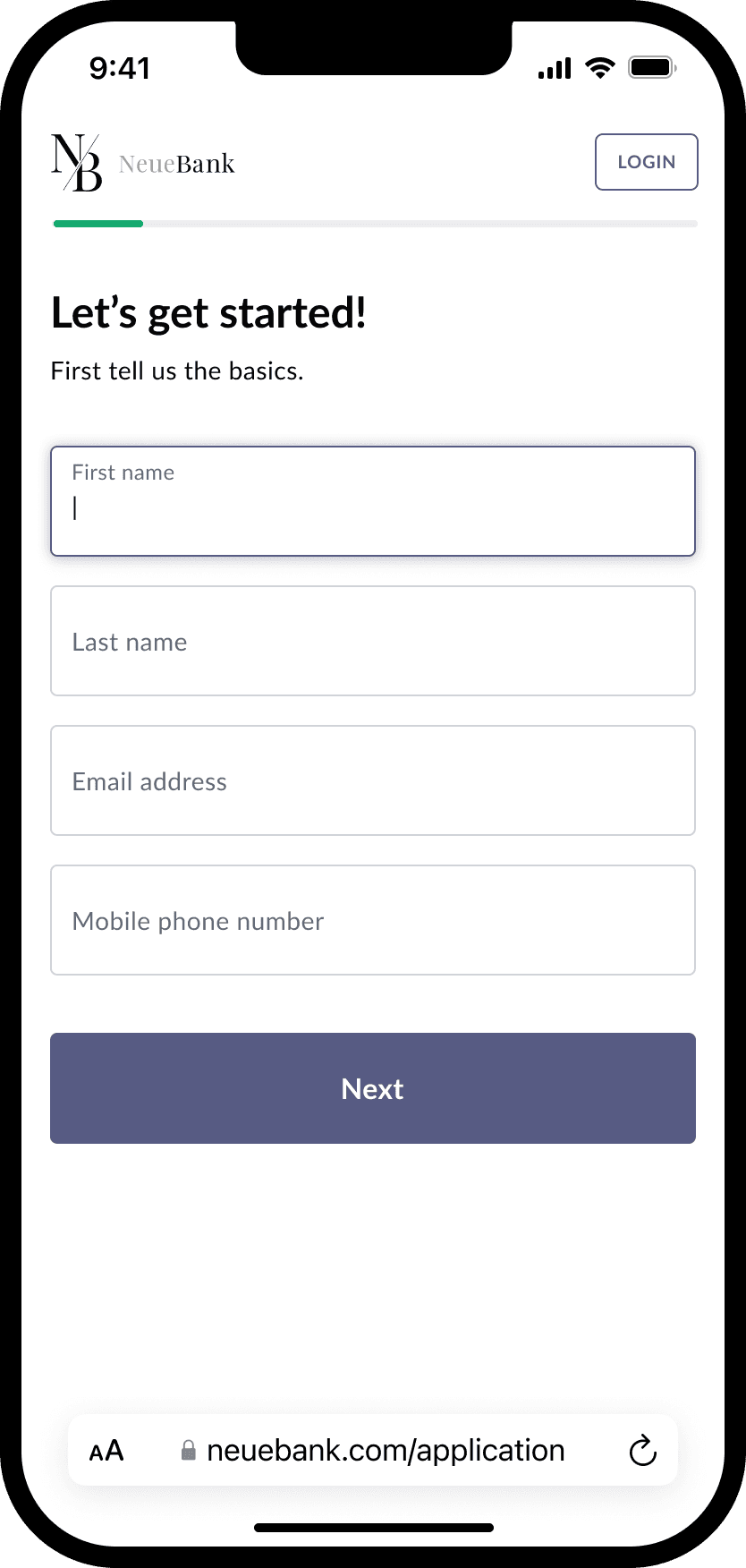

Getting started

Decreased completion time

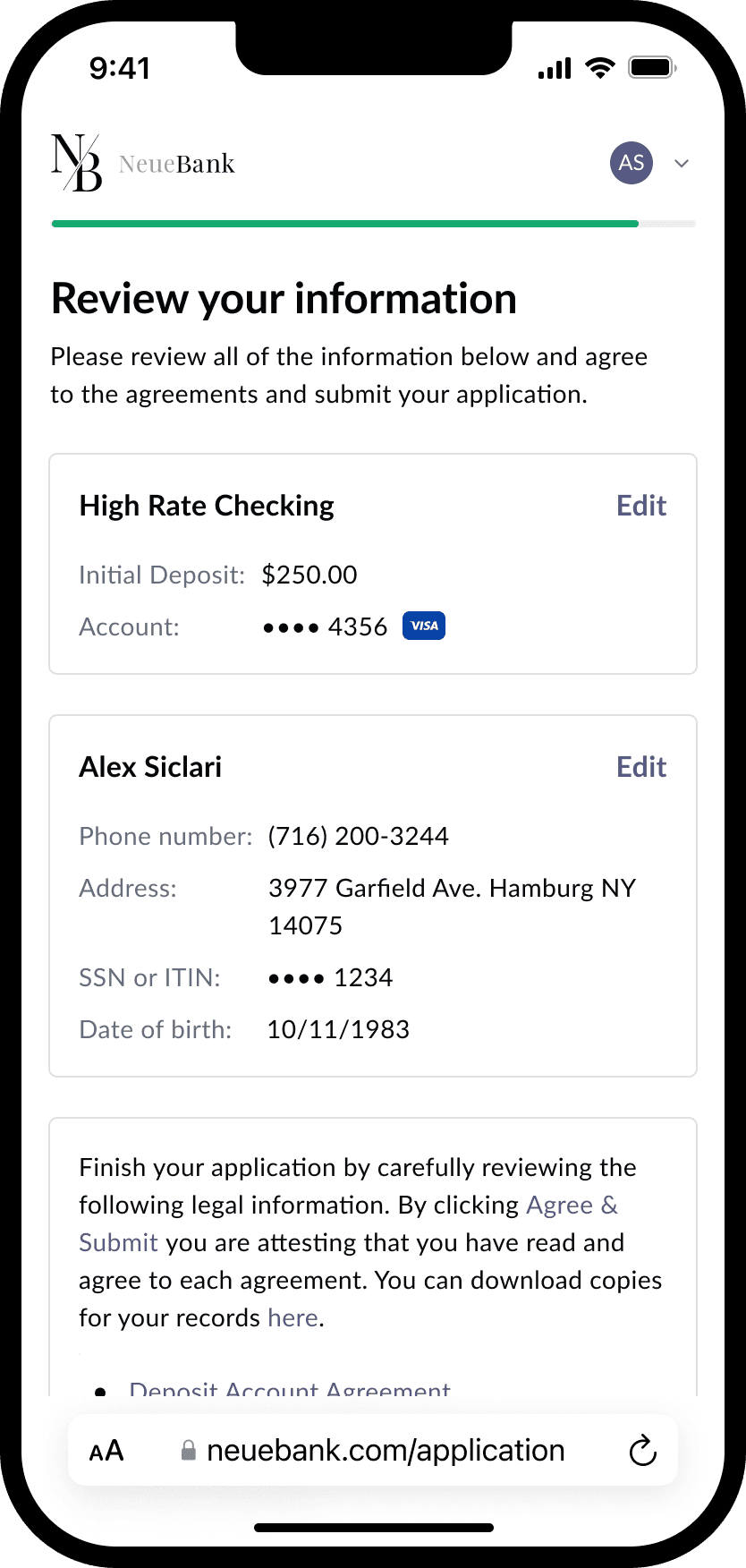

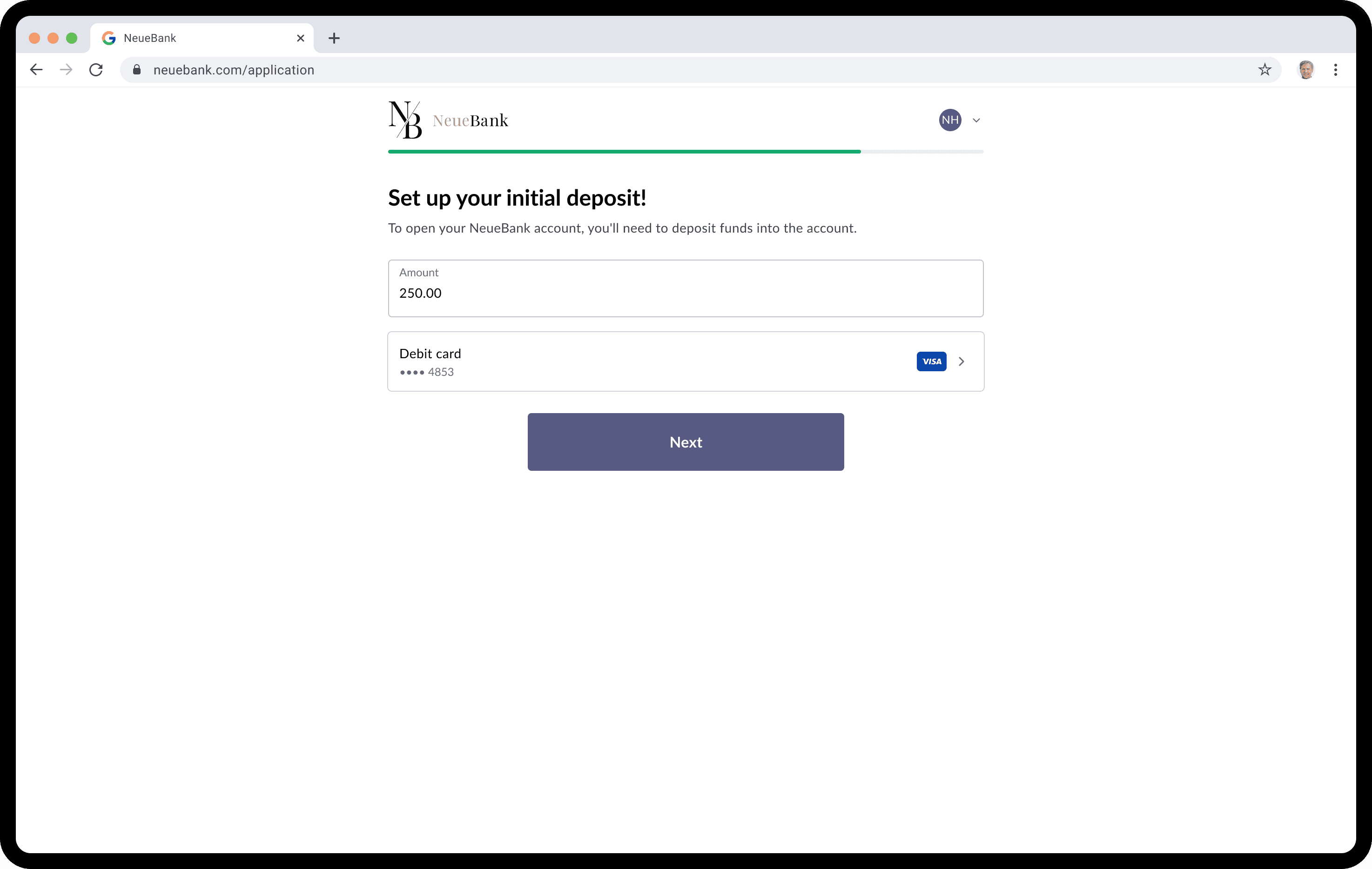

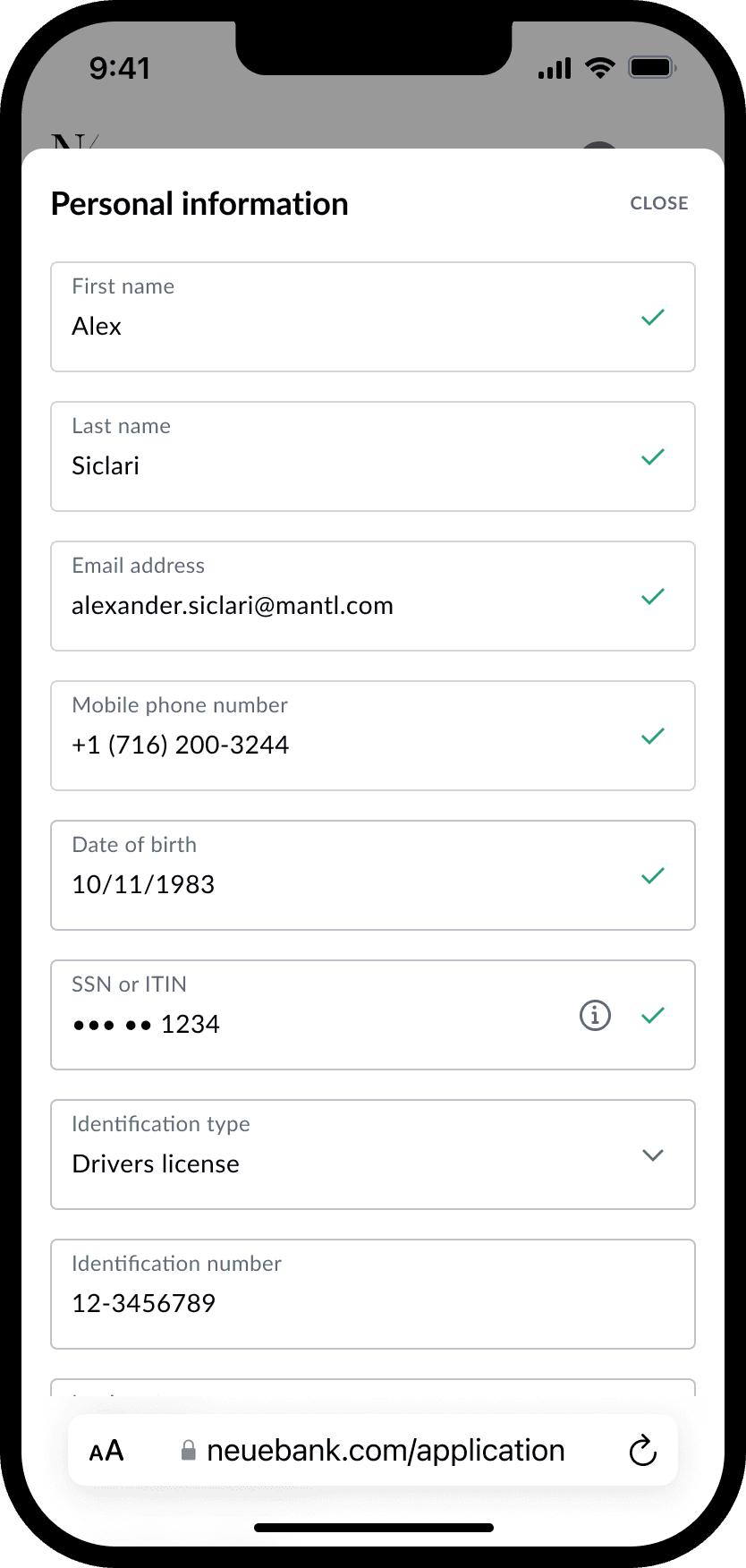

By giving users a simplified stepped approach for the application and adding a step where people could review all of their information, we found that it reduced the time that a user would need to navigate back and forth between steps. By doing this, we ensured that a user could fix all of their information and cutting down on routing issues and time to complete the application.

15:45

Before

5:40

After

Building ShareFile's design system

From complex to cohesive. Our journey building a design system that made ShareFile more accessible, faster, and future-proof.

Prizmway

A marketplace for creating meaningful agreements and relationships between shippers and carriers.